The Philippines economy saw a 10% jump in retail digital payment between 2020-2021, resulting in 30.3% payment to be digital in 2021. This jump brought the economy a step closer to its target of reaching 50% digital payments by 2023, with a corresponding aim to achieve financial inclusion for at least 70% of its citizens. While this jump came in the backdrop of the pandemic and the need to switch to digital methods, it brought in opportunities to leverage digitalization as a means to create an inclusive environment for the previously excluded and unbanked segments of the population. This article will uncover diverse aspects of the Philippines journey towards digitalization of payments, playing a major role in achieving a digitally-inclusive future.

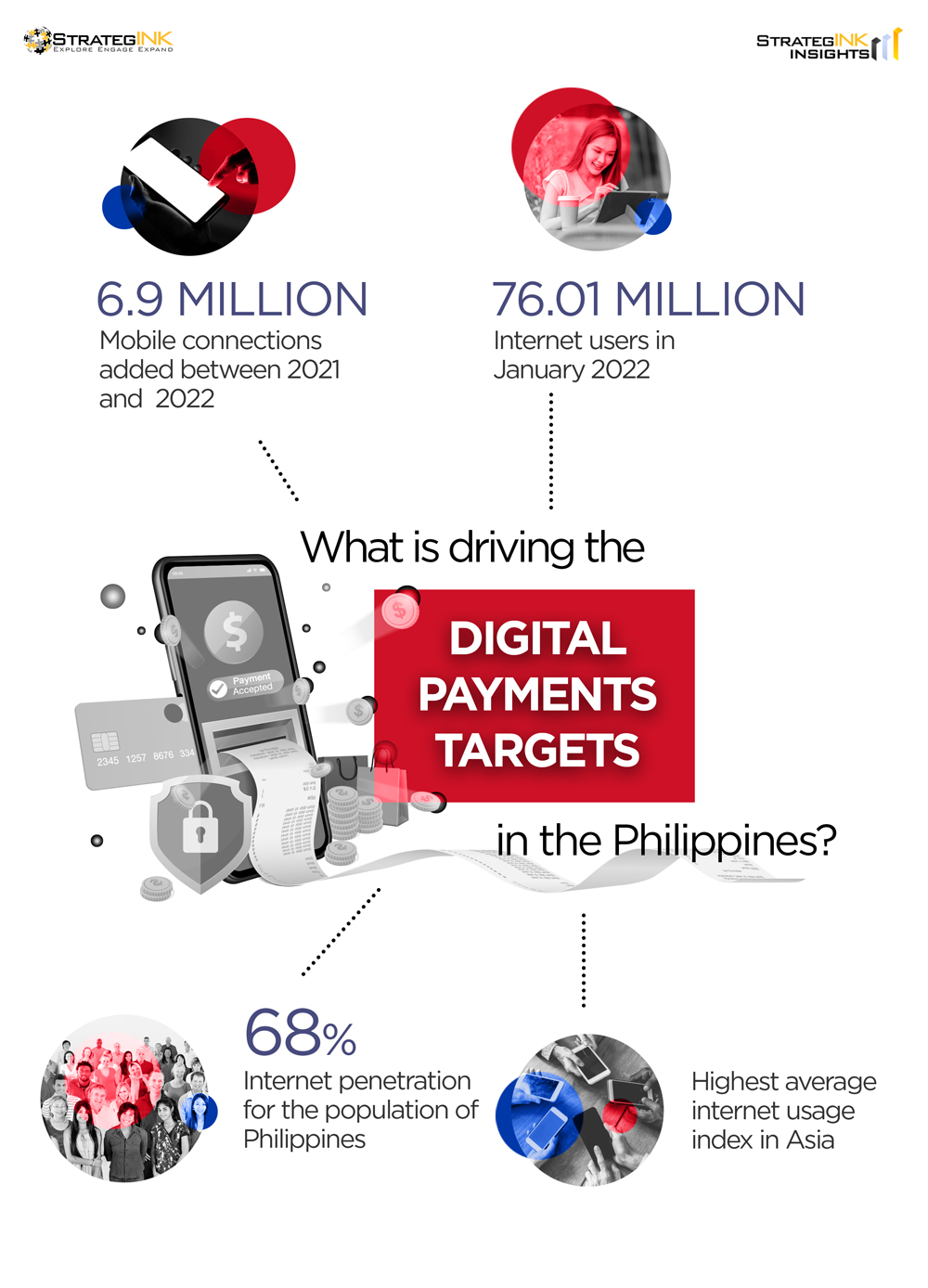

What is driving the digital payments target in the Philippines?

| Click to enlarge |

- 6.9 million mobile connections added between 2021 and 2022

- 76.01 million internet users in January 2022

- 68% internet penetration for the population of Philippines

- Highest average internet usage index in Asia

Despite the overall positive trend in digital adoption and digital penetration, the country has seen a majority of the citizens being underserved, when it comes to financial and other critical services. With multiple islands dispersed geographically, the country has seen digital divide as one of the areas to work on. From a financial inclusion lens, almost 70% citizens of the country don’t own a bank account, which is the most basic indicator of financial inclusion. While almost 70% of adults in the country own a mobile phone, only 12% use it for digital financial transactions.

Thus, digital payments in the Philippines are being driven by a combination of three forces:

- First, high level of digital penetration, creating a use case for digitization of payments

- Second, digital payments as a means to bridge the financial inclusion gap in the country and create access of financial services for underserved communities

- Third, leveraging financial inclusion as a means to set the stage for a digitally inclusive future for the dispersed islands which together form the Philippines

To promote its agenda of financial inclusion, the Central Bank of the country, Bangko Sentral ng Pilipinas (BSP), set out the target to digitize 50% of the relatil payments with its Digital Payments Transformation Roadmap.

Digital Payments Transformation Roadmap

The BSP set out the twin goals of promoting financial inclusion and achieving digitalization of payments through a combination of digital payments innovation, enabling policies and regulations, etc. The digital payment transformation commitment in the Philippines stands on three major pillars, including digital payments streams, digital finance infrastructure and digital governance standards. These pillars are being supported by an enabling regulatory and policy environment along with high levels of inter-agency/ stakeholder collaborations. Let’s understand each of the tenets.

Pillar 1: Digital Payments Streams

Under the first pillar, the Philippines government is focused on creating large scale and widespread use cases for digital payment across diverse stakeholders including the government, the consumers and the businesses. Each use case is being highlighted for its safety, benefits and reliability. The objective is to drive broader adoption of digital payments for businesses and consumers by widening the digital payment streams available and with initiatives like Direct Debit, National QR Code, Request to Pay, etc.

Pillar 2: Digital Finance Infrastructure

In addition to diverse payment streams, the next focus on the Philippines is on creating a robust digital finance infrastructure to facilitate interoperability of payments and seamless transactions. The major objective is to have an effective infrastructure to support responsive and innovative financial services. This will enable wider distribution of digital products and services along at lower costs with a high speed of delivery, enhancing adoption of digital payments.

Pillar 3: Digital Governance Standards

The creation of new payment streams and digital infrastructure will be guided by the third pillar of ensuring global digital governance standards. The objective is to have a robust regulatory framework in place to ensure that all payment streams, new services, etc. meet minimum technical requirements, ensure security and respect and protect the privacy and integrity of consumer data.

Key initiatives for 50% digital retail payments

With a key target to digitalize at least 50% of retail payments, the Philippines seeks to capitalize on the launch of three e-payment streams, namely, Bills Pay, Request to Pay, and Direct Debit:

- Bills Pay aims to bridge the existing bill payment system which is currently fragmented to allow customers to directly pay electricity, water, and telephone bills even if their and the biller’s accounts are in different financial institutions.

- Request to Pay will enable the payee to initiate payment collection by sending a “request to pay” to the payor without the need to provide the account details or the amount, and the payer can simply authorize the payment with one click.

- Direct Debit facilitates better management of recurring payments by enabling payees to pull funds from the account of payors.

Addressing cybersecurity concerns proactively

Digital transactions and adoption of financial technologies will make high levels of information, especially financial data, open to cyber threats. Understanding the sensitivity of the matter, the Philippines government has already put in action several policies and interventions including:

- Tightening the reporting regime of supervised institutions

- Formulating policies to proactively manage cybersecurity risks

- Electronic banking guidelines to update baseline security controls for electronic payments

- Creating supervisory tools like Cybersecurity Controls Self Assessment template

- Implementing programs to enhance cybersecurity awareness and digital literacy among citizens

Next steps for a financially inclusive Philippines

Undoubtedly, the potential for financial inclusion by fostering a digital payments ecosystem is enormous for the Philippines. To achieve its target, there are some areas that the country needs to address, including:

- Enabling mindsets towards benefits of digital payments

- Reducing barriers to enter the formal financial/ banking system

- Bridging the digital divide

- Enhancing overall digital networks with the presence of fast and reliable internet connectivity in the country

With these basics in place, the Philippines will seamlessly lead the adoption of digital payments at the national and local levels, adding a feather to its digitally-inclusive future. Invariably, this will be a major building block for the country to achieve digital inclusion and adoption across sectors and ultimately, build a digital nation, across its dispersed islands.

For more updates on the digital journey of the Philippines and other ASEAN countries, stay tuned to this space.