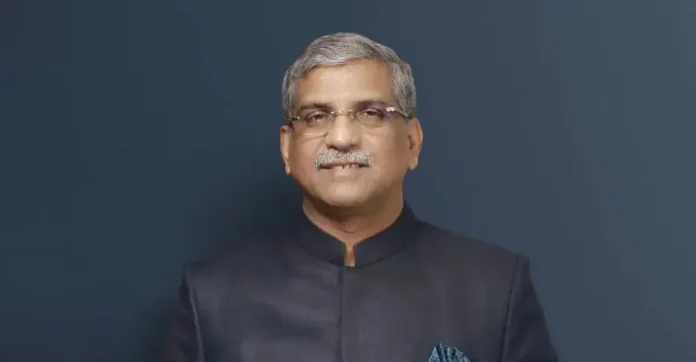

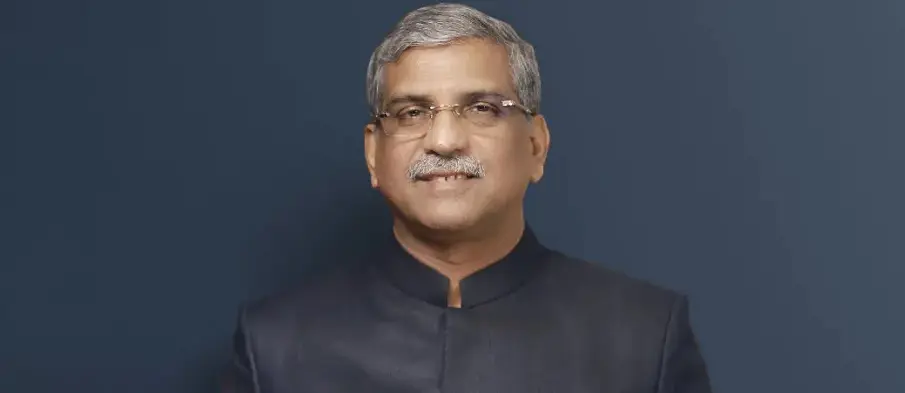

Paul Thomas, Managing Director and CEO of ESAF Small Finance Bank, has been appointed as the Chairperson of Sa-Dhan, the association of microfinance and impact finance institutions. Previously, Thomas served as the co-chair of Sa-Dhan.

Paul Thomas is the Founder of the ESAF Group, which includes ESAF Microfinance and Investments Pvt Ltd. With over 32 years of management experience, including more than 25 years in microfinance, he has significantly contributed to community transformation through financial inclusion. Before founding ESAF, he spent 18 years at the Indian Farmers Fertilizers Co-operative Ltd (IFFCO), where he realized the potential of microfinance in uplifting rural communities. He has also been active on the boards of several microfinance apex bodies and founded the Kerala Association of Microfinance Institutional Entrepreneurs (KAMFI).

ESAF Small Finance Bank began as an NGO in 1992, focusing on the sustainable transformation of the poor and marginalized. Now, it serves urban, semi-urban, rural, and unbanked areas, emphasizing inclusive banking. Inspired by the success of Grameen Bank in Bangladesh, ESAF expanded into microfinance in 1995 and formalized its operations in 2008 with the establishment of ESAF Microfinance and Investments Pvt. Ltd.

Sa-Dhan, recognized by the RBI as a Self-Regulatory Organization (SRO) for Microfinance Institutions, is the leading association of microfinance and impact finance institutions in India. Formed over two decades ago, it supports the growth of inclusive impact finance. Sa-Dhan has approximately 220 members operating in 33 states/UTs, reaching around 44 million clients with loans totaling over ₹1,27,801 crores. It is also recognized as a National Support Organization (NSO) by the National Rural Livelihood Mission (NRLM).

Sa-Dhan’s diverse membership includes for-profit and non-profit MFIs, SHG-promoting institutions, banks, rating agencies, and capacity-building organizations. Together, they work to enhance the microfinance sector’s understanding among key stakeholders, including policymakers, banks, and researchers.