Advisor

StrategINK

Digital transformation is increasingly impacting virtually every industry today. The same is true for enterprise resellers, commonly known as channel partners. The majority of these channel partners play a vital role in the sale of hardware and software product and services to the end clients spread across multiple verticals – MDI (Manufacturing & Distribution Industries), CME (Communication Media & Entertainment), BFSI (Banking, Financial Services & Insurance) & PS (Public Sector). It is increasingly becoming imperative for business needs to use digital technology to sustain and grow. Else, they may get disrupted by their more digitally agile partners. Digital transformation has already become imperative for enterprises to gain a competitive edge. Enterprises ahead in the digital transformation curve are driving business transformation and innovation. By adopting digital technologies such as cloud computing, the Internet of Things, mobility, and analytics, digitally transformed channel partners can meaningfully engage with such customers proactively. The following article will answer three fundamental questions for enterprise resellers to survive and thrive in the digital age. What have been the top 5 challenges that enterprise resellers are witnessing in the face of digital transformation? Digital means risk. The key factors impacting channel partners are summarized below:

- Shrinking of Go-To-Market due to rapid adoption of cloud & associated technology by customers; the explosion of cloud, reduced market potential for on-premise back-end technologies and shifted contracts from high-value, one-time transactions to monthly recurring revenue (MRR) agreements.

- Presently reactive selling is leading to the erosion of margin / diminishing bottom line & losing competitive advantage. The reseller finds it challenging to transform part or all of its business into effectively that of a service provider – how do they manage the billing; cash flow implications; business complexities which can become a barrier to digital adoption.

- Ability to change from “Product led Services Sales” to “Service led Product Sales”; In addition, selling skills of CapEx to OPEX is also causing a hindrance in leveraging the market opportunity.

- Understanding the rapidly changing business agility (solutions for automated cars, digital oil field solutions (e.g.), Use of data analytics for business benefits – e.g. shopfloor efficiency) of the customer vertical and aligning the right solutions

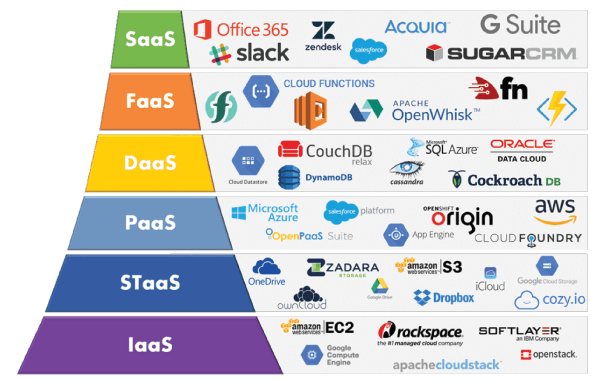

- Reskilling of resources for the new age solutions – Cyber Security, IoT, AI/ML, Blockchain, Manufacturing 4.0 & Smart Factories, Big Data & Analytics, SDWAN & virtually selling everything as a Service (ref. diagram below for ready reference).

What are the opportunities that digital disruption has opened up for enterprise resellers? The India Digital Transformation (DT) Market has reached USD 42.56 Billion in 2019 and projected to reach USD 1764 Billion by 2026 with a significant CAGR of 72.3% during the forecast period 2020-2026. The private and public sectors are both driving digital consumption growth. South India is expected to be the fastest-growing region in India. The top 7 sectors expected to drive DT in India would be BFSI, Healthcare, eCommerce, Logistics, Education, Smart Cities & Agriculture. The National Digital Communications Policy, 2018 seeks to offer the transformative power of digital communications networks in achieving the goal of digital empowerment and improved well-being of Indians. The Policy aims to accomplish certain strategic objectives by 2022 including-

- Provisioning of broadband for all.

- Creating 4 million additional jobs in the digital communications sector.

- Enhancing the contribution of the digital communications sector to 8% of India’s GDP from around 6% in 2017.

- Enhancing India’s contribution to global value chains.

- Ensuring digital sovereignty.

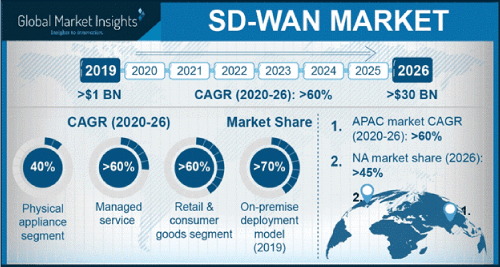

It aims to harness the power of emerging digital technologies, including 5G, AI, IoT, cloud, and Big Data to catalyze Industry 4.0 by promoting investments and innovation. Also, note that the explosion of IoT devices (estimated to be 8.4 billion connected things in operation last year, according to Gartner – 2B in India alone) with over 4B in the enterprise has accentuated Cybersecurity solutions within both the Date Centre & the edge. SD-WAN catalyzes network transformation. Exponential growth in data traffic (due to the adoption of hybrid cloud, bandwidth-intensive applications etc.) is creating immense pressure on legacy enterprise networks. Enterprises in India want their network to have the ability to change network policies automatically as per the requirement of workloads and applications of the organization. The on-demand networking approach should have a centralized control so that automatic, real-time, and dynamic configuration and bandwidth allocation can be performed as per the requirement of applications and workloads. This market is growing at a compounded CAGR of 60%+ (Ref. chart below)

How can enterprise resellers leverage this wave of digital transformation to strengthen their position? For enterprise resellers seeking to leverage the opportunities presented by digital transformation, the following four practices can help gain a competitive edge: Organization restructuring with the right talent. Formulate & align strategy. Move from reactive selling to proactive engagement to stay ahead of the curve for competitive advantage. The rate of innovation in technology and disruption of business models is exponential – making it a challenge to develop an IT strategy that will be relevant for 3-5 years – course correct, if necessary. Put data to work. Big data analytics can give reseller companies to have customer insights in near real-time. Predictive analytics is the new name of the game to anticipate new needs. The inclusion of IoT data from various devices, phones and machine sensors, will enable a wider net of automation across all operations and the opportunity to drive new efficiencies and business models. It will also help in customer retention & acquisition. Digital transformation is a journey. Investment decision around people and process needs to be complemented by understanding the business outcomes of customers. The year 2020 will go down as the period when organizations responded to new risks, pivoted to new business models – driving faster overall digital transformation adoption, particularly when it comes to technologies enabling remote work. In contrast, IT departments are struggling to “Do more with Less”. Due to this dual dynamic, one of the more crucial digital transformation success factors is that enterprises thoroughly evaluate the value of the initiatives to ensure maximized investment value and returns. If I have to summarize, the following would be the key recommendation for the Channel Partners:

- Understand and anticipate digital disruption of channel business

- Understand why or why not digital transformation is critical for channel business

- Develop a data-driven mindset, visualize and derive actionable insight from data using data visualization and storytelling techniques

- Understand management and utilization of strategic digital assets

- Use digital technology for:

- Customer insights

- Customer acquisition

- Customer retention

- Reputation management

- Reskilling of all internal resources may be time-consuming – we may need to hire fresh resources from the market and release the nonskilled resources

- Acknowledge that “Changing nothing is risking everything”; A large proportion of existing channel businesses would be consolidated away, with survivors forced to reinvent virtually every aspect of their operations otherwise.

About the author

Barun was Director – Industry Vertical Sales in his last assignment at Hewlett Packard Enterprise. In this position, he was responsible for overall Enterprise Sales in India across all the verticals – Banking & Finance, Communications, Media & Entertainment, Manufacturing & Distribution Industries and Public Sector & Midmarket Business. In his capacity, he was also responsible for Enterprise-class business from Inbound Global Accounts, total amounting to ~ USD 750 Million.