The Growing Threat of Cybercrime in Bangladesh

Bangladesh’s financial industry is increasingly threatened by cybercrime, which mirrors global trends. With over 116 million internet users by 2021, and the government’s “Digital Bangladesh” campaign driving 40% annual growth in the ICT sector since 2010, the environment is ripe for sophisticated cyberattacks. Financial fraud instances have increased, resulting in anticipated yearly losses of more than BDT 800 crore.

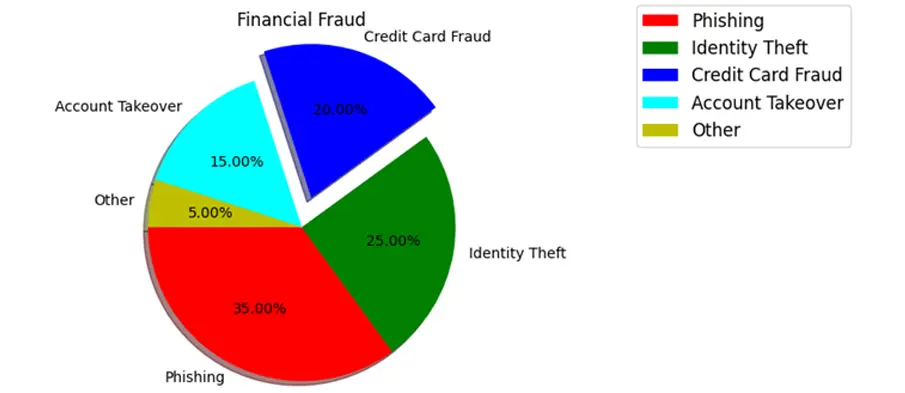

Phishing attacks, which deceive people into disclosing sensitive information, have had a substantial impact in Bangladesh, with instances increasing by 25% annually. This development matches global concerns with phishing costing organizations over $26 billion between 2016 and 2019.

Ransomware, which encrypts files until a ransom is paid, is a major danger to Bangladesh’s financial industry. A 2020 attack on a major Bangladeshi bank resulted in data breach totaling BDT 50 crore.

Identity theft and account takeovers are escalating, causing significant financial losses. In 2020, over 800 cases of fraudulent transactions due to identity theft were reported in Bangladesh, resulting in losses exceeding BDT 200 crore.

Insider threats, in which trusted individuals abuse their access, are frequently overlooked. A recent analysis found a 15% increase in insider-related incidents in Bangladesh’s banking sector in a year, resulting in significant financial and reputational damage.

Synthetic identity fraud, in which criminals establish fake identities using both actual and generated information, is a developing threat. This form of fraud is difficult to identify and has cost the Bangladesh financial system BDT 300 crore.

Role of AI and ML in Combating Financial Fraud

Faced with today’s complex cyber threats, traditional fraud detection techniques are becoming obsolete. AI and ML systems can evaluate large volumes of data, discover trends, and detect inconsistencies that indicate fraudulent activity.

Advanced AI and ML techniques like Graph Neural Networks (GNNs) and Generative Adversarial Networks (GANs) are revolutionizing fraud detection. GNNs map transactions to identify unusual patterns, while GANs create synthetic fraud instances to train systems to recognize actual fraud. Reinforcement Learning (RL) adapts to evolving threats.

AI and ML enable real-time data processing and analysis, which is critical for detecting fraud in the financial sector. Apache Kafka and Apache Flink technologies enable real-time transaction monitoring and anomaly detection.

Platforms like IBM QRadar and Splunk use AI-driven analytics to monitor network traffic and correlate events from multiple sources, enhancing financial institutions’ resilience against cyber-attacks.

Zero Trust Architecture (ZTA) assumes threats can be both inside and outside a network. With 82% of data breaches involving a human element, ZTA is essential to mitigate risks from insider threats and human error.

Building a culture of cybersecurity awareness through continuous education and training is essential. As Bangladesh’s financial sector expands and digitizes, strong cybersecurity measures are required. These technologies can protect institutions and clients from growing cyber threats.