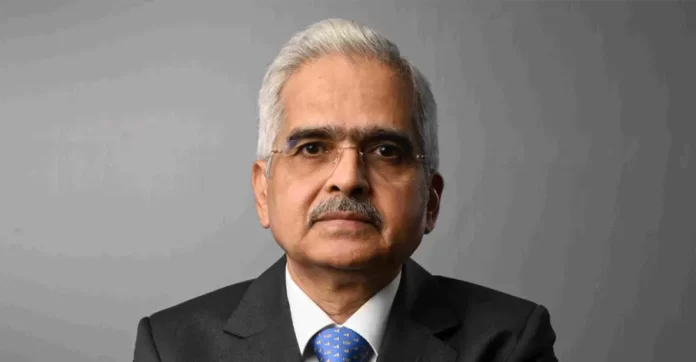

During his address at the Annual Conference of RBI Ombudsman, Reserve Bank of India (RBI) Governor Shaktikanta Das emphasized the amplified cybersecurity risks arising from the integration of artificial intelligence (AI) into financial systems. He urged financial institutions to prioritize the protection of customer data amidst the evolving technological landscape.

Das highlighted the significant responsibility of regulated entities in managing extensive repositories of sensitive financial and customer data. He stressed the potential for enhancing customer service through thorough data analysis, advocating for proactive use of data analytics to effectively anticipate and address customer needs.

Recognizing the growing threat of fraudulent activities, particularly in digital transactions, Das emphasized the importance of strengthening monitoring mechanisms and leveraging technology to preemptively identify and mitigate risks. He emphasized the need for comprehensive root cause analyses of consumer grievances to prevent their recurrence, especially in light of the escalating cybersecurity challenges posed by AI.

The governor underscored the critical importance of reinforcing cybersecurity measures to mitigate risks such as identity theft and unauthorized access to personal information, which could erode consumer trust in financial institutions. He urged institutions to allocate significant resources to promptly identify and address vulnerabilities, ensuring robust protection of customer information.

Das also emphasized the significance of efficient grievance redressal mechanisms as a measure of the efficacy of financial institutions. He cautioned against fragmentation and inefficiency in grievance redressal processes, advocating for streamlined procedures to expedite the resolution of consumer complaints.

Highlighting the transformative impact of the RBI-Integrated Ombudsman Scheme (RB-IOS), Das noted substantial improvements in grievance resolution efficiency since its inception. He emphasized the scheme’s success in reducing turnaround times and enhancing overall operational efficiency.

Furthermore, Das stressed the need for continuous improvement in internal grievance redressal systems within regulated entities, advocating for the adoption of data-driven approaches and technological innovations to uphold public trust. He called for collaborative efforts between regulatory bodies and financial institutions to address systemic deficiencies and reinforce consumer confidence in the financial sector.